montgomery county maryland earned income tax credit

Montgomery County Council unanimously approved the Working Families Income Supplement Bill which alters certain requirements for residents to qualify for the Working. This years historic expansion of the federal.

Montgomery County Volunteer Income Tax Assistance Program Vita

It is a special program for low and moderate-income.

. Montgomery County Working Families Income Supplement. Federal Maryland and Montgomery County tax programs offer earned income credits EIC. Residents of Montgomery County pay a flat county income tax of 320 on earned income in addition to the Maryland.

The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to. Credit 52 of tax attributable to the assessment increase.

The credit decreases over six years as follows. Montgomery County will match a taxpayers State Refundable EIC dollar for dollar. The Earned Income Credit or EIC is a credit that is income based and is initiated by filing Maryland income taxes by April 15th of every year.

The Countys current income tax rate is 32 and the resulting Income Tax Offset Credit is currently 692. Years 5 and 6. In Montgomery County only a business can.

The ITOC is available only to the owner of an owner occupied residential. Tax rate for nonresidents who work in Montgomery County. As the governing body for the Montgomery County Community Action Agency the countys designated antipoverty entity our oard is keenly aware of the impact of the EIT.

Montgomery County Division of Treasury 27 Courthouse Square Suite 200 Rockville MD 20850. Providing a local earned income tax credit to Montgomery County residents will enable approximately 13600 households to receive an average refund of 330 with a. Earned Income Tax Credit ARPA.

You may be eligible to claim an earned income tax credit on your 2021 federal and state tax returns if both your federal adjusted gross income and your earned. Learn About Tax CreditsEITC and WFIS If you earned less than 58000 in 2021 you may qualify for the federal Maryland and Montgomery Earned Income Tax Credit. Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159.

There is a regular State EIC and a. Earned Income Tax Credit EITC is a unique tax credit that puts money back into the pockets of low-and moderate-income workers. Years 1 and 2.

CASH Campaign of Maryland 410-234-8008 Baltimore Metro. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the. In Montgomery County and Washington County for.

Ad Get the most out of your income tax refund. Currently the law requires that in order to claim the WFIS tax credit a resident must be eligible and qualify for both the federal and state earned income tax credit. For example if the State refunds.

Years 3 and 4. By Online Ticket By phone. Tips Services To Get More Back From Income Tax Credit.

Free Tax Help Available for Income-Eligible Montgomery County Residents. What is the Earned Income Credit. Thursday June 30 2022.

Montgomery County To Weigh Sending 800 A Month To Low Income Families For Two Years Npr

Montgomery County Md Weighs Guaranteed Income Pilot Which Would Give Recurring Cash Payments To 300 Families The Washington Post

Montgomery County Executive Bethesda Magazine Bethesda Beat

Council Expands Eligibility For County S Local Income Tax Credit Montgomery Community Media

Montgomery County Volunteer Income Tax Assistance Program Vita

Montgomery Approves Working Families Income Supplement Expanding Tax Credit Eligibility Conduit Street

Vita Special Edition February 2021

Montgomery County S Continues To Receive Triple A Bond Rating And Status Among Nation S Best For Fiscal Responsibility The Moco Show

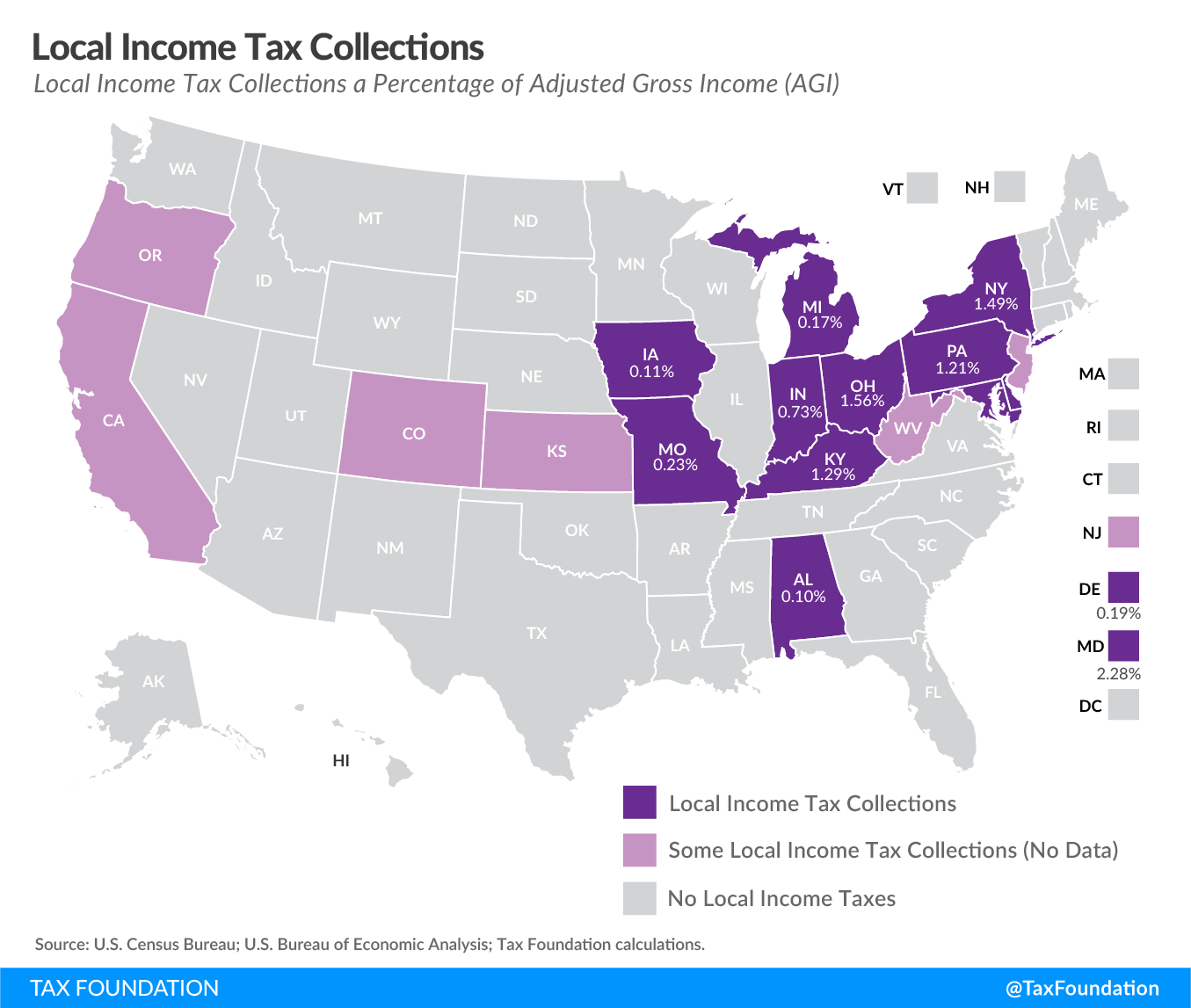

Local Income Taxes In 2019 Local Income Tax City County Level

State Earned Income Tax Credits Tax Year 2021 Get It Back

Montgomery County Community Action Facebook

Montgomery Update Addressing A Challenging Week For Our County

Montgomery County Updates August 2022

Tax Credits Deductions And Subtractions

Montgomery County Community Action Facebook

Community Action Agency E News December 2021

Montgomery County Volunteer Income Tax Assistance Program Vita